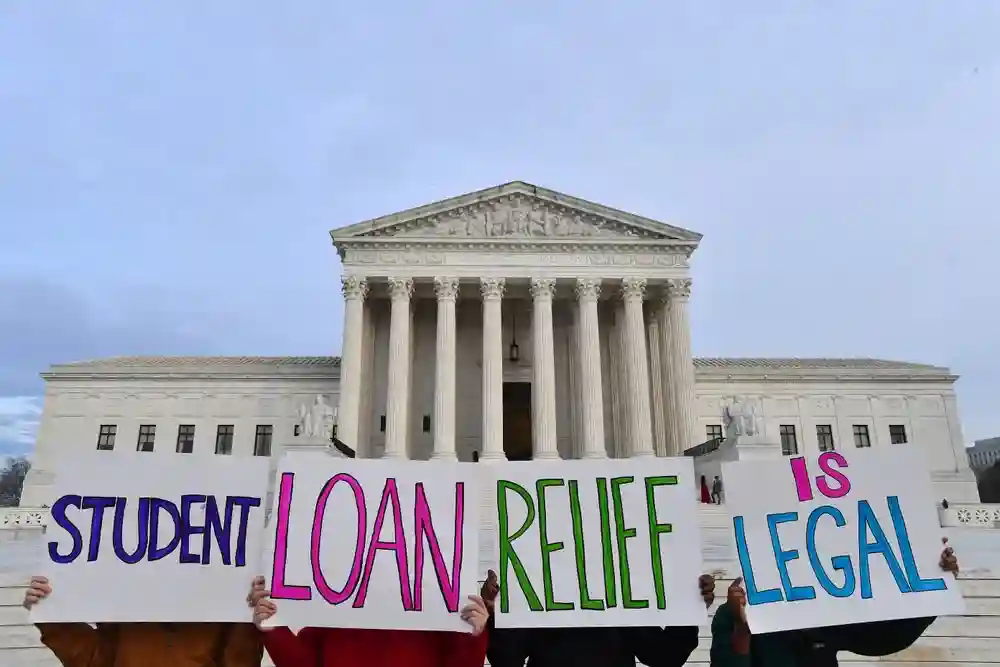

The Supreme Court to hear student loan forgiveness challenges. Two legal challenges to the historic student loan forgiveness program of the Biden administration will be heard by the Supreme Court.

The Supreme Court to hear student loan forgiveness challenges. Two legal challenges to the historic student loan forgiveness program of the Biden administration will be heard by the Supreme Court. (Photo by https://www.businessinsider.com/)

As its debt relief plan goes before the Supreme Court, the Biden administration is currently unable to fulfill its pledge to erase up to $20,000 in college debt for tens of millions of Americans.

America’s top court will rule on student debt relief in the coming months, and the result will be the last word for debtors.

Read More: Student Loan Forgiveness Cancelled: To Pay Again This Summer

Biden’s Student Loan Forgiveness Program Agreed By 16 Million Students: Will Supreme Court Uphold?

On February 28, the Supreme Court heard oral arguments in two student loan forgiveness challenges opposing President Joe Biden’s proposal to forgive up to $20,000 in federal student debt for each borrower, with a judgment due by late June. The nine justices grilled the parties involved with inquiries about their legal standing, the merits of their cases, and the fairness of the plan, which caused the arguments to linger nearly four hours—far longer than the two hours originally anticipated.

Many Americans are eagerly awaiting word from the Biden administration regarding its plans for widespread student loan forgiveness. Most recently, it was said that the White House was leaning toward a $10,000 cancellation plan per borrower (for those who make under $150,000). (Photo by Getty Images)

Oral arguments in a case contesting President Joe Biden’s jurisdiction to erase up to $20,000 in student loan debt per borrower through the Department of Education will be heard by the nation’s highest court. At a cost of $400 billion to the government, those borrowers would fare far better under a Biden victory in the High Court. (Photo by Getty Images)

and that debt cancellation is required to prevent an unprecedented increase in delinquencies and defaults.

The Supreme Court will decide whether or not to implement the promised reduction in student loan debt for nearly 40 million Americans. The validity of President Biden’s student loan forgiveness proposal was the subject of arguments before the court in important cases. The Washington Post’s Danielle Douglas-Gabriel and NewsHour Supreme Court Analyst Marcia Coyle joined John Yang in a discussion of the arguments. (Photo by https://www.pbs.org/)