Series of Interest Rates Hikes Housing Market Highly to Crash Like 15 Years Ago

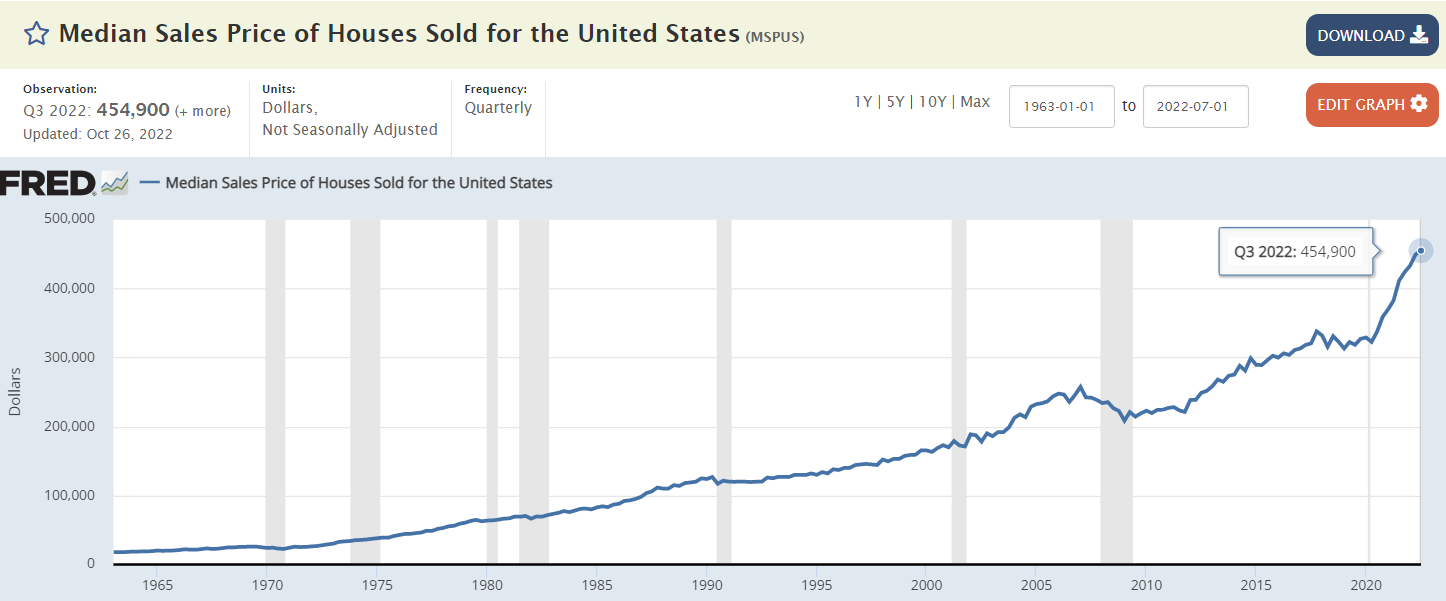

In 2007 fifteen years ago, U.S. housing worth were at an all-time high. According to the St. Louis Fed, the median price for a single home was $257,400, a record. After a series of rate climbs, the Fed funds rate reached 5.25%, its highest point in six years. The Fed was raising interest rates.

The once-considered Great Recession officially started in late 2007 and lasted 18 months. Housing prices were about to encounter a contraction of historic proportions. We didn’t know it at the time, but a multi-year recession was about to begin.

Exactly fifteen years have passed, and we are roughly two weeks away from the first quarter of 2023. The most current data from the St. Louis Fed shows U.S. housing prices at an all-time high. The median price of a U.S. home is $454,900, a record.

Some of the top business leaders in the country, including Andy Jassy of Amazon (AMZN) and Mark Zuckerberg of Meta Platforms (META), are flagging financial difficulty ahead as they lay off thousands of workers. The Fed is increasing interest rates. Earlier this week, the Fed funds rate reached 4.5%, its highest point since 2007.

Suppose a buyer buys a median-priced U.S. home for $455,000. a mortgage of $364,000 is created if the buyer makes a down payment of 20%, or $91,000. Earlier around two years ago, a 30-year fixed-rate mortgage featured an interest rate of 3.25%. Without including taxes and insurance, this would have induced payments of $1,584 per month.

Series of Interest Rates Hikes Housing Market Highly to Crash Like 15 Years Ago (Photo: Yahoo Finance)

The Housing Market Crashed Under Similar Circumstances 15 Years Ago

According to a published post by Yahoo Finance, a 30-year fixed-rate mortgage comes with an interest rate of about 6.5%. Today’s fee on a $364,000 loan would be about $2,300, an increase of over $700 per month compared to two years ago.

Meanwhile, the same customer who is faced with this payment is struggling to make ends meet, due to historically high inflation. More demand will be removed if jobs are lost during a recession. It removes a substantial amount of demand from the housing market.

Despite all of this happening, home-building stocks are still soaring high. XHB has risen above its key 50-day (blue) and 200-day (red) moving averages.

The bellwether S&P Homebuilders SPDR (XHB) has gained about 18% since its bottom on October 21.

Roughly fifteen years ago, under somehow similar occurrences, the housing market was about to have a huge impact and crash down. The lending abuses that happened back then haven’t been repeated, and the economic awakening for millions of Americans stays undeniably stark. There will probably be no 2008 repeat but housing will definitely underperform by 2023.

READ ALSO: US Labor Costs Increase As Job Markets, Interest Rates Shift