Earlier this month, the Michigan Senate passed a tax package that increases the earned income tax credit for families and cuts down the state’s retirement tax in a late-night vote.

Gov. Gretchen Whitmer’s “inflation relief checks” proposal was left out of the legislation because Democrats could not win enough Republicans to support it. Conservative legislators would have needed more votes to approve the $180 refund cheques for each Michigan taxpayer.

An ongoing decrease in the state’s income tax rate may be implemented instead.

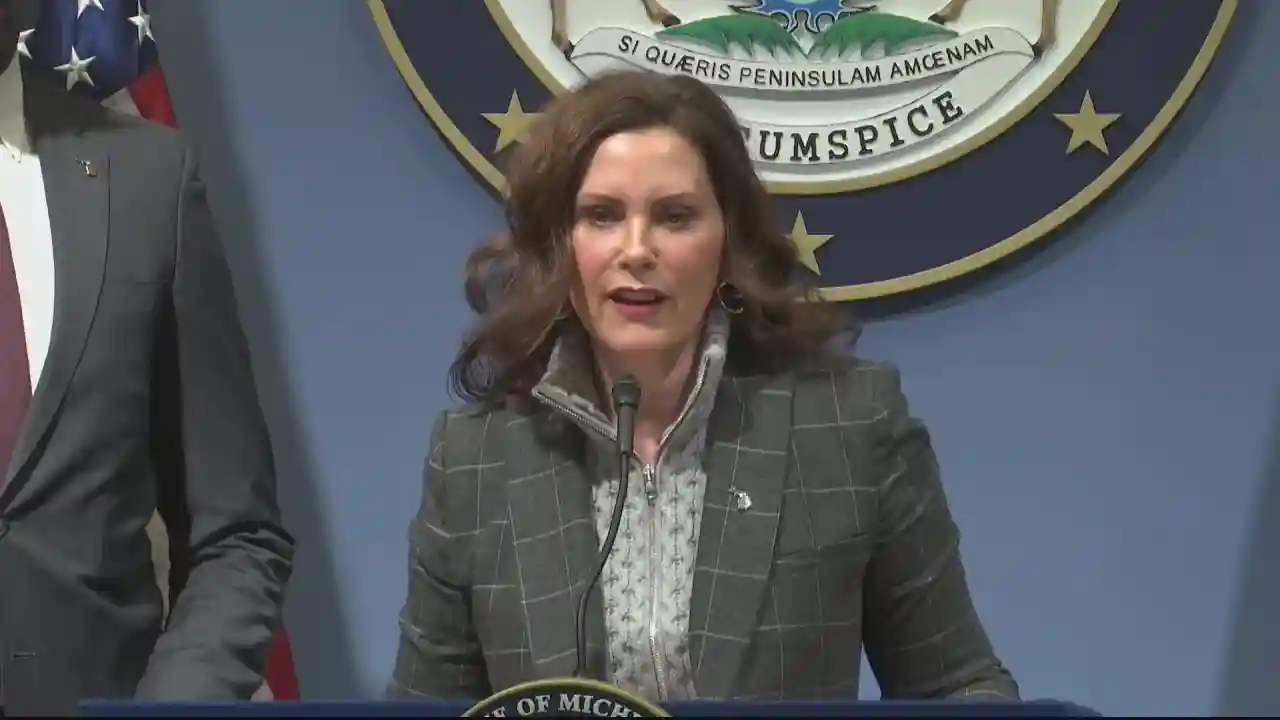

In the event that a recently announced plan is approved by the state Legislature, the state of Michigan may send checks to all taxpayers as an inflation relief measure. The state of Michigan may provide each Michigan taxpayer $180 this year as part of the Lowering MI Costs proposal. Even while the sum may not seem like much, officials stated on Monday that it will operate in concert with larger tax credits to offer more substantial relief to individuals who are working full-time but are still struggling. (Image courtesy of www.youtube.com)

Michigan Taxpayers to Miss $180 Inflation Relief Checks

The new proposal would not provide taxpayers with $180 inflation relief checks, ClickOnDetroit mentioned.

Democratic leaders said the payments would offer some immediate comfort in addition to other relief-inducing measures in the proposal, even if some felt the previously intended $180 checks to taxpayers were inadequate. Republicans in the legislature opposed that aspect of the proposal, claiming that cutting tax rates would give a better long-term solution to help alleviate the situation than the checks would.

The chance to reduce Michigan’s income tax rate from 4.25% to 4.05% would have been lost if the $180 checks had been sent. Therefore, they were issued instead.

ALSO READ: Here’s What You Need To Know About Inflation Relief On March 2023

Will It Help Michigan People?

Yet, the new strategy aims to help a variety of Michigan people.

The state retirement tax will gradually disappear for four years under the Reducing Healthcare Expenses Plan. It would “equalize the exemption on both public and private pensions,” according to officials.

Fox2 Michigan said the modification to the earned income tax credit, which raises the amount working people get from their tax return from 6% of the federal rate to 30%, is anticipated to provide families with the largest financial boost.

At the 6% rate, a single parent with two children earning $20,000 would have received $370. Nevertheless, at 30%, they will get $1,849.

Seniors will find a growing portion of their retirement income free from taxes as a result of the reduction of the retirement tax. In 2023, a 65-year-old will have 25% of their income free from taxes, saving, on average, nearly $1,000 annually.

RELATED ARTICLE: Tax Relief Leads: See What You, Lawmakers Should Prioritize