The Child Tax Credit is a federal tax credit designed to support families with children financially. The credit was expanded and made more generous under the American Rescue Plan Act of 2021, which is in effect for the 2022 tax year.

Your tax return will undoubtedly be a bit more complex if you have a new kid than if you were simply filing for yourself or jointly with your spouse.

On the plus side, based on your income, you may be eligible for various new tax credits and deductions.

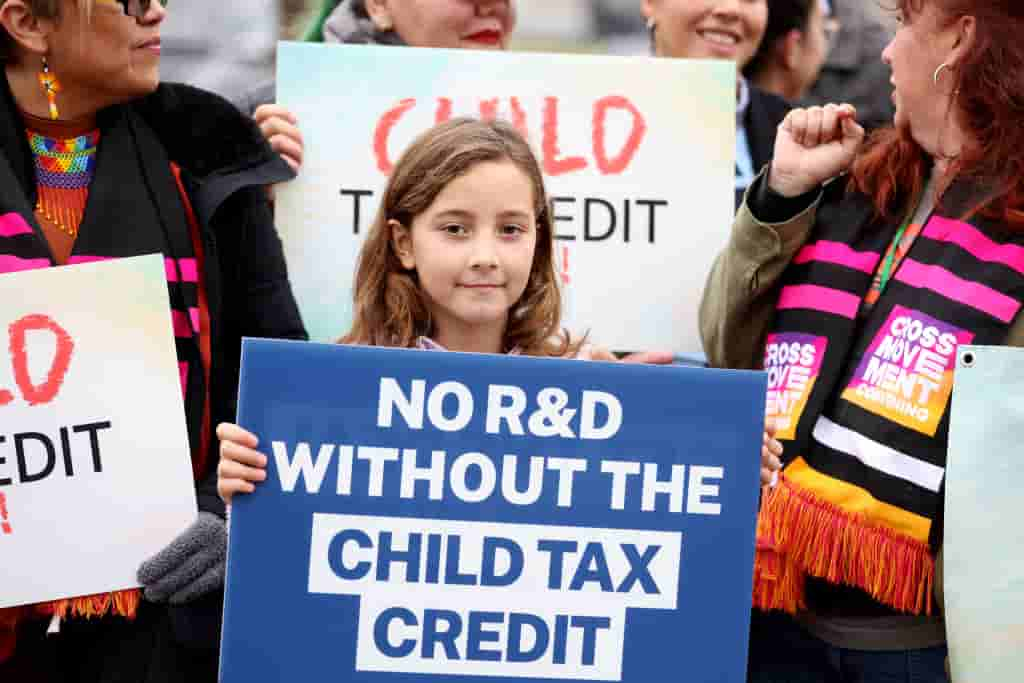

WASHINGTON, DC – DECEMBER 07: Supporters attend Press Briefing With U.S. House And Senate Champions, Impacted Families on Expanding the Child Tax Credit During Lame Duck Session on December 07, 2022 in Washington, DC. (Photo by Tasos Katopodis/Getty Images for Economic Security Project)

Child Tax Credit: How to Claim Benefits This Year

If you are a parent or guardian of a child under 17, you may be eligible to claim the Child Tax Credit on your 2022 tax return. Here’s how you can claim it, according to TurboTax:

Determine Eligibility

To claim the CTC benefits, you must meet certain eligibility requirements. You must be a parent or guardian of a child who was under the age of 17 on December 31, 2022. Additionally, the child must be a U.S. citizen, national, or resident alien and have a valid Social Security Number.

Calculate the Credit Amount

The CTC has two components: a non-refundable portion and a refundable portion. The non-refundable portion is worth up to $2,000 per child and can be used to reduce your tax liability to zero. The refundable portion, known as the Additional Child Tax Credit, is worth up to $1,400 per child and can result in a refund even if you owe no taxes.

Gather Required Documentation

To claim the CTC, you must provide documentation for each child, including their name, SSN, and relationship to you. If you are claiming the Additional Child Tax Credit, you must provide proof of your earned income.

File Your Taxes

NerdWallet said you can claim the Child Tax Credit by filing your federal tax return using Form 1040 or 1040-SR. If you are claiming the Additional Child Tax Credit, you will also need to complete Schedule 8812.

Claim the Credit

When you file your federal tax return, you can claim the CTC by entering the total credit amount on the appropriate line of your tax form. If you are claiming the Additional Child Tax Credit, you must enter the amount on Schedule 8812 and attach it to your tax return.

ALSO READ: Ohio Child Tax Credit Expansion An Asset; Here’s Why

When to Expect CTC Payment?

Before the middle of February, the IRS cannot disburse any more child tax credit refunds.

Early filers who chose direct deposit as their refund option, electronically completed their return, and provided an error-free submission may start seeing refunds arrive in their accounts by February 28.

The “Where’s My Refund” feature will start updating statuses for early filers by February 18 if you wish to check the status of your return before then.

It’s important to note that the CTC rules and eligibility requirements can change yearly. Check the latest information from the Internal Revenue Service to confirm your eligibility for the 2022 tax year.

By following these steps, you can claim the Child Tax Credit and receive the financial support you need to care for your children. With the expanded credit amounts under the American Rescue Plan Act, many families can expect significant tax savings this year.

RELATED ARTICLE: Still Haven’t Received Any Child Tax Credit Or Stimulus Check From The IRS? Here’s What You Should Do!