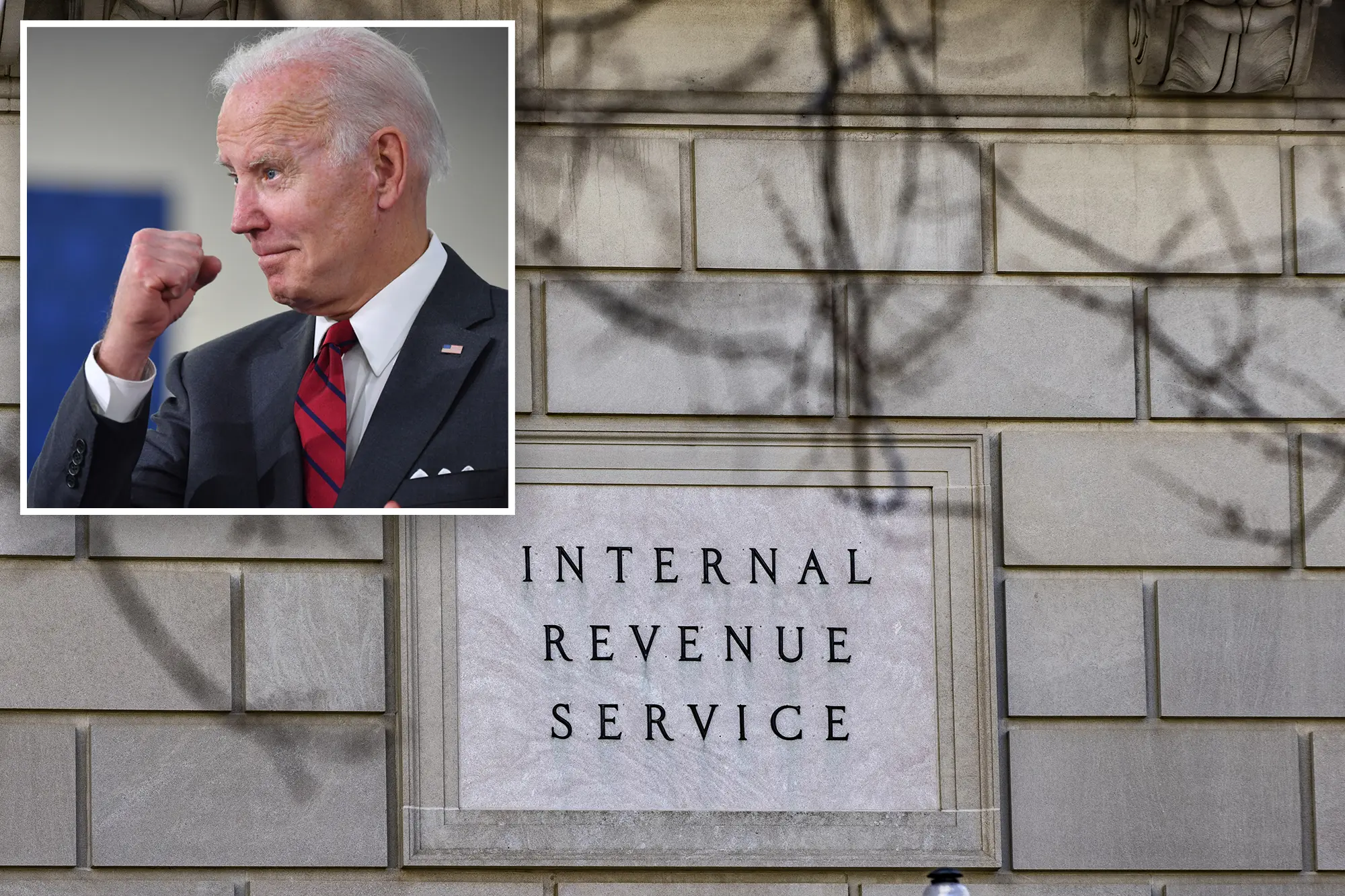

For the past 2 years, the IRS has inspected President Joe Biden’s and First Lady Jill Biden’s federal income taxes; during one of those audits, the first couple was asked to pay a little more than they had officially owed.

Andrew Bates, the deputy press secretary for the White House, said, “The regular audits were conducted for both of these administration’s years. The IRS ruled that the president and first lady were eligible for an extra federal income tax refund for the 2020 tax year. It was discovered, they had an additional $13 for the tax year 2021. This amount might have been canceled under IRS rules, but they opted to pay it.”

The House Ways and Means Committee discovered this week that while the IRS was successful in completing its audits of the Bidens, none of former president Donald Trump’s audits were completed during his 4 years in office. Information on the Biden audits was first revealed by The Wall Street Journal.

This week, House Democrats quickly introduced legislation requiring annual audits of sitting presidents and publishing of their returns in response to the disclosure of tax agency information proving the lack of audits. By a vote of 222 to 201, the House on Thursday adopted the bill mainly along political lines.

According to the proposed law, the IRS would be allowed to release an early report regarding its review of the president’s tax return “[n]Ot later than 90 days after the filing of a President income tax return.” The IRS will also be required to submit an updated report every 180 days with an estimated completion date, with a final report due 90 days after the IRS finishes its audit.