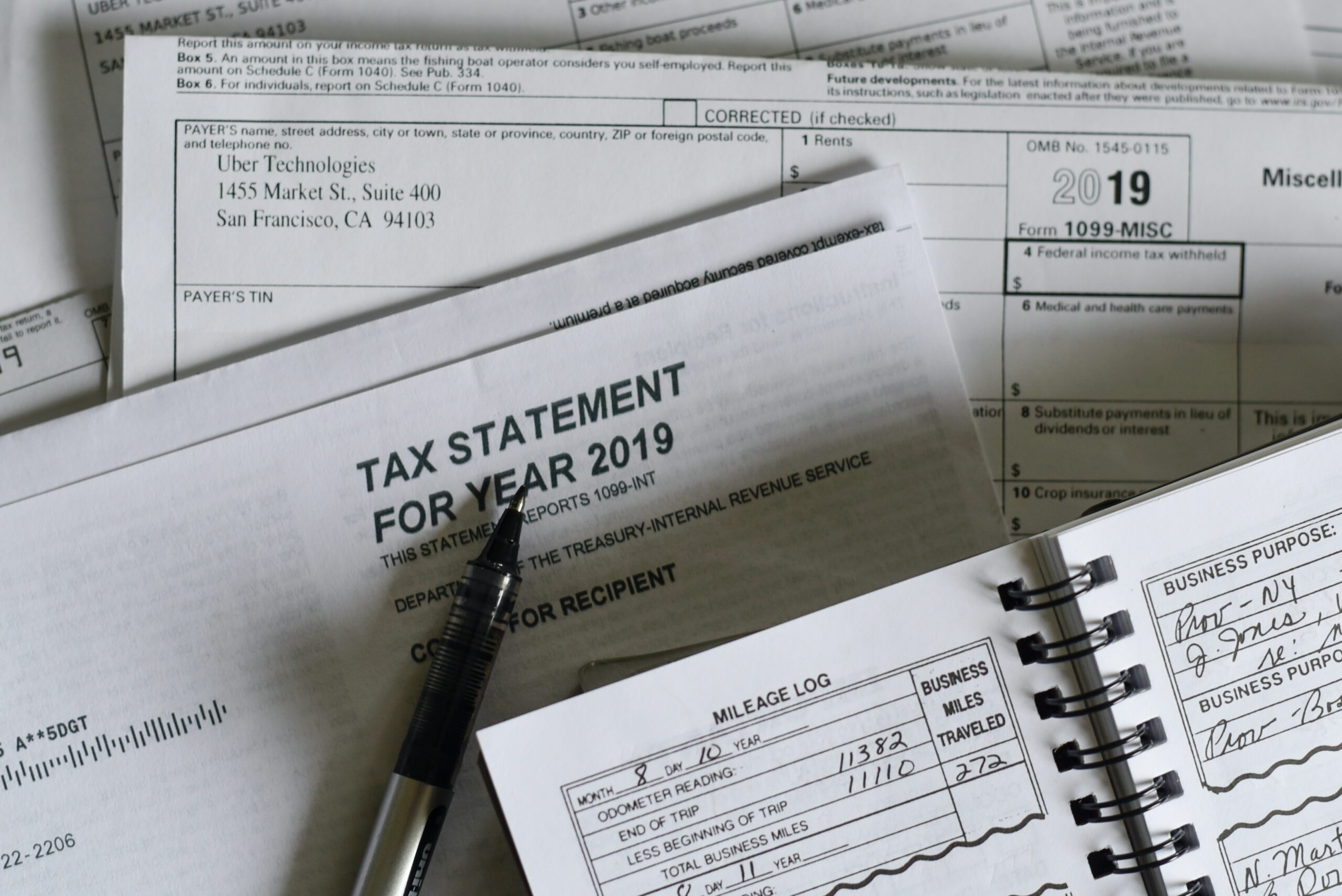

In light of an unprocessed backlog of 6 million individual tax returns dating back to 2019, the Internal Revenue Service has suspended automated warning letters for this year’s tax filing season. People usually receive these letters from IRS when their taxes are due automatically.

Stopping these letters will avoid confusion

According to NBC News, the IRS said in a statement that there are several instances where a tax return may be a part of their present paper tax inventory and has simply not been processed because of backlogs. Stopping the distribution of these letters, which may have reached thousands of taxpayers, will assist to minimize confusion.

The IRS also stated that the issuance of CP80 and CP080 (Unfiled Tax Return — Credit on Account) warnings has been discontinued due to processing delays for 2019 and 2020 tax returns.

According to them, they should refile their 2019 tax return if they receive a notification for it more than six months after they filed it. If they receive a notification for their 2020 return, they should not submit a new return.

Child tax credit payouts could be a potential headache

As MSN reported, tax season officially began on Monday, and one potential source of stress could be the payment of the remaining portion of the expanded Child Tax Credit, which was paid in advance to millions of families from July to December.

According to certain tax professionals, some notices from the IRS regarding money that has already been paid out are inaccurate. The IRS stated on Monday and reiterated on Thursday that the inaccurate numbers on Letter 6419 are isolated issues.

“The IRS is reviewing the situation, but we believe this is a limited group of taxpayers involved out of a much larger set of advance Child Tax Credit recipient,” IRS added, as quoted in the report.

The agency also stated that there is no evidence to substantiate the notion that hundreds of thousands of taxpayers could be affected by this situation.

Read More:

Advocates Urge Lawmakers to Advance New Stimulus Check as Omicron Variant Surges

Four Different States to Receive Stimulus Checks to Alleviate Poverty