Internal Revenue Service’s new commissioner delivered a tax season pledge Tuesday that the agency will $80 billion infusion of cash to become faster and real-world progress to taxpayers.

Guarantee And Quicker And Easier Tax Filing Method

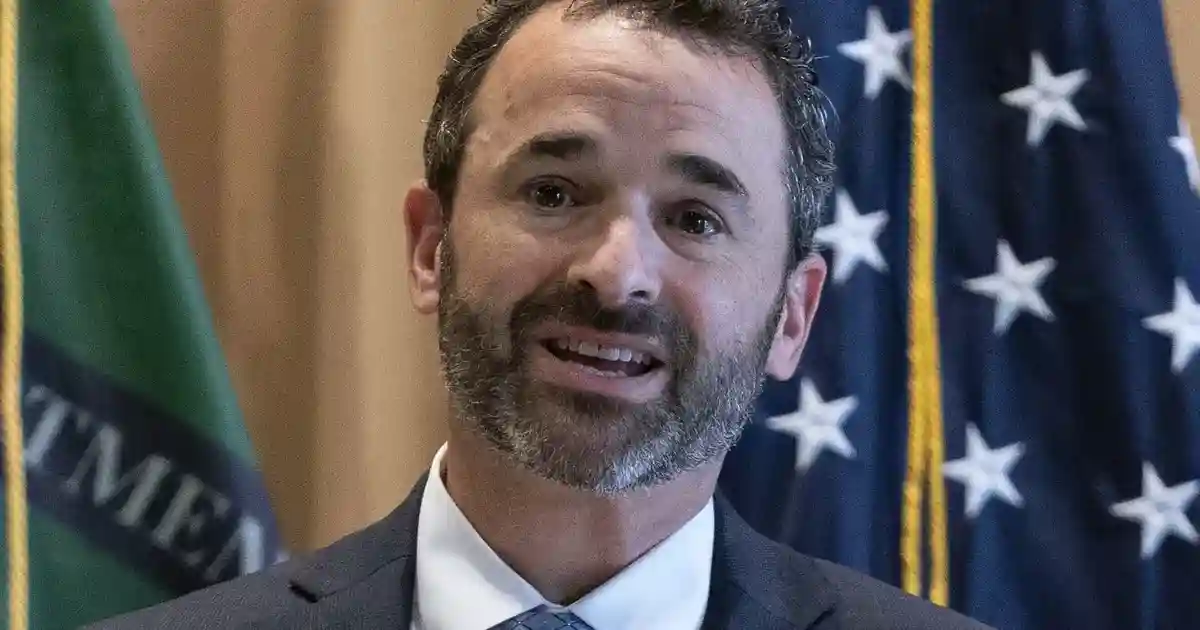

Danny Werfel, ceremonially sworn in on Tuesday, said he would dismiss a strategically operating strategy delinquent this week laying out how the instrument will use the finances authorized in the previous year’s Inflation Reduction Act.

Werfel promised before the senators not to extend surcharge audits on companies and families making less than $400,000 per year, as he looked through rounds of inquiries before the Senate Finance Committee on how he would devour the agency’s large new input of capital. He pulled honor for being willing to leave a personal consulting career to take on the top job problem agency.

Treasury Secretary Janet L. Yellen, who oversaw Werfel’s swearing-in said, in a speech to IRS and Treasury workers that he will be assigned with “dramatically making better taxpayer assistance and providing that extensive companies and the wealthy income the taxes they owe.”

READ ALSO: Tax Day 2023: IRS Releases Options For Taxpayers Unable To Pay Their Tax Bill

Quicker And Easier Tax Filing Method

Syracuse investigation, better than half of the resemblance audits prompted by the IRS last year – 54% – pertained to low-income employees with putrid tickets of less than $25,000 who declared the earned revenue surcharge credit, an anti-poverty standard. Dissimilarity is chiefly anticipated by high-income taxpayers retaining difficult acquisitions that can easily shroud the intervals between taxes owed and reimbursed vs. taxes registered and paid.

READ ALSO: 2023 Tax Season: Taxpayers Using Financial Firms Should Receive The Form 1099