After being stopped for more than three years, federal student loan payments are expected to start up again in the next few months.

Several reports have mentioned that the government has proposed a plan to forgive up to $20,000 of each borrower’s federal student loans.

Some states and lenders are going to court to stop the plan, and the Supreme Court is expected to decide by June 30.

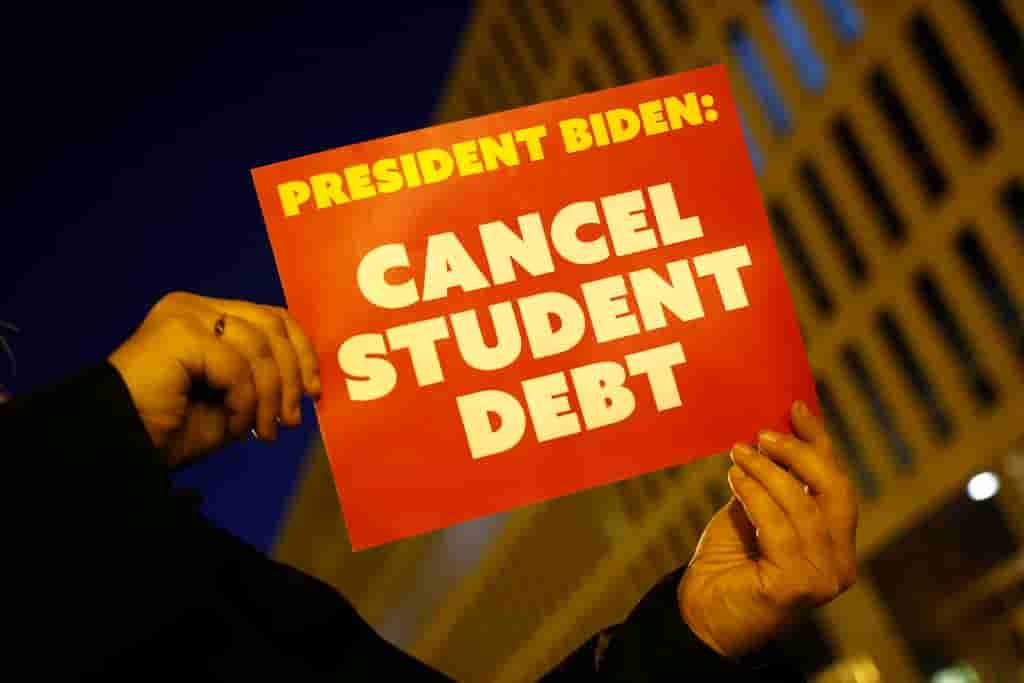

WASHINGTON, DC – MARCH 14: On the second anniversary of the student loan payment pause, We, The 45M, project a message on the outside of the U.S. Department of Education celebrating the pause and asking Education Secretary Cardona to cancel student debt on March 14, 2022 in Washington, D.C. (Photo by Paul Morigi/Getty Images for We The 45 Million)

If they decide to keep the plan, the Education Department is expected to implement the debt relief program and extend the time between payments until then. If the court throws out the plan, payments will start 60 days after that again.

Since President Joe Biden announced his plan to get rid of up to $20,000 in student loan for tens of millions of Americans, many legal challenges have stopped the government from giving out the help.

Still, people who borrow money should be ready for bills to return sooner rather than later.

Student Loan Payments Still on Hold

Marca said that the student loans are still on hold. How and when did the U.S. How soon the U.S. Department of Education starts collecting again on student loan payments depend on how long it takes the Supreme Court to decide on the debt-forgiveness plan of the Biden administration.

In February, the Supreme Court spent three and a half hours listening to arguments in the cases that questioned the student debt relief plan. Lawyers and people who want to get rid of debt have questioned this idea.

While that was happening, U.S. Solicitor General Elizabeth Prelogar talked about the problems that borrowers face on student loan payments.

She said that it has been hard for millions of Americans for the past three years to pay their rent, utilities, and food bills. Many have also been unable to pay their debts.

Prelogar pointed out that student loan payment forgiveness is the most common type of debt relief, and that the education secretary acted within the core of his power and in line with the main goal of the HEROES Act when he did this.

READ ALSO: Student Loan Relief Update 2023: Is One-Time Payment Adjustment Enough?

Borrowers May Ask For Deferment, Forbearance

Experts told CNBC that borrowers who don’t have the money to pay back their loans could get more time to settle their student loan payments.

Mark Kantrowitz, an expert on higher education, said that undergraduate and graduate students could get deferments and forbearances.

When the break is over, you can put off making payments on your student loans for longer by asking for a deferment or a forbearance.

Experts say borrowers should check to see if they qualify for a deferment. With a deferment, interest may not be added to the loan, but it almost always is with a forbearance.

If you are out of work when your student loan payments start again, you can ask your servicer for a “deferment for unemployment.” If you have another financial problem, you may be able to get a deferment because of economic hardship.

Those with student loans who don’t qualify for a deferment can ask for a forbearance.

Borrowers can put their loans on hold for up to three years if they choose this option. But since interest builds up during the forbearance period, borrowers may have to pay more when it’s over.

Kantrowitz gave an example: Under a forbearance, the interest on a $30,000 student loan with a 5% interest rate would go up by $1,500 yearly.

If a borrower uses forbearance, he suggests that they at least try to keep up with their interest payments so that their student loan payment debt doesn’t worsen.

Kantrowitz said that a deferment or forbearance should only be used as a last resort, but they are better than not paying back the loans.

Betsy Mayotte, who runs a non-profit called The Institute of Student Loan Advisors, said in the same CNBC report that borrowers should only use a forbearance or deferment for short-term hardships like an unexpectedly large medical bill or a time when they don’t have a job.

Mayotte said that borrowers having trouble making their payments should find a plan that works for them.

READ ALSO: What Will Happen If You Stop Student Loans Payments?