Here are rumors of bankruptcy. Bank robbery. A last-ditch effort to raise money. A bank collapse. Market falls—worries about a financial crisis spreading.

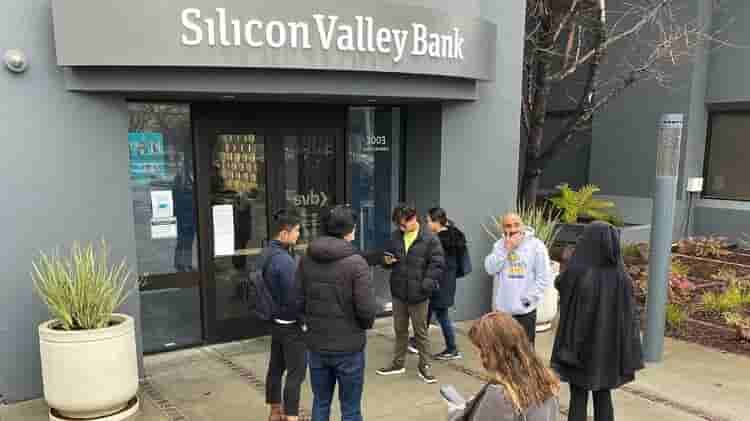

History is being repeated. Silicon Valley Bank, a lender targeted at start-ups, technology companies, and rich people, was shut down by California authorities today. The bank was given to the Federal Deposit Insurance Corporation as a receiver. Since about Monday, account holders with deposits of less than $250,000 would have complete availability to their money, according to the FDIC. Account holders who have more, which, based on the bank, represent the vast number of entities banking with SVB, must wait and observe.

This disaster will affect the entire Bay Area and the tech sector. The most significant concern in the short term is that start-ups using SVB for everyday banking may be unable to pay employees in the next days and weeks, allowing them to skip a payment or perhaps declare cutbacks or layoffs. The concern is that businesses having cash in other, smaller banks in the medium future would be concerned about their security, withdraw money, and cause a financial crisis.

The long-term risk is that the government may wind up saving SVB, showing that almost all banks in the US financial system are too large to fail.