Mortgage Rates Shoots to 7%! This week, mortgage rates accelerated their ascent to 7% and drove more potential buyers back to the sidelines.

According to Freddie Mac, the rate on the typical 30-year fixed mortgage climbed to 6.50% from 6.32% the week before. Rates rose by 41 basis points this month as a result of official statistics showing that inflation marginally climbed in November, reversing the most of the reduction that had been occurring since mid-November.

Mortgage rates remained just shy of 7% this week—the 30-year fixed rate loan is at 6.94%—which could be a “new normal” after recent rapid increases in borrowing costs, says Nadia Evangelou, senior economist and director of forecasting for the National Association of REALTORS®. Mortgage rates have been hovering near 7% for the last month. (Photo via Getty Images)

Homebuyers’ demand has been constrained by the abrupt increase in rates, which has forced inflation-weary buyers to reduce their budgets or cancel their purchase plans. The few purchasers who are still in the market are negotiating purchases in the interim before rates further reduce their purchasing power.

Housing affordability has been destroyed, according to Keith Gumbinger, vice president of HSH.com, who spoke with Yahoo Finance. “Having said that, there is a healthy amount of demand for homes and the ability of prospective purchasers to participate in the market, but there are still too few properties available from which to choose at a price a potential buyer can really afford. When taken together, these factors are cooling the market.

Aspiring home buyers saw signs of hope for greater affordability this week as the average 30-year mortgage rate dropped to 6.49%, Freddie Mac reports. Recent economic data suggests mortgage rates have peaked after surpassing 7% in the second week of November. (Photo via iStock/Getty Images Plus)

Demand for homes declined even further

A growing number of prospective homebuyers have decided to abandon their plans as mortgage rates rise.

According to the Mortgage Bankers Association’s (MBA) study of applications for the week ending February 17, the number of mortgage applications for a purchase decreased by 18% from the prior week. The amount of purchase applications overall decreased 41% from the previous year, and the purchasing index fell to its lowest level since 1995.

In a statement, Joel Kan, vice president and deputy chief economist of the MBA, noted that although buying activity usually increases at this time of the year, rates have risen sharply in recent weeks. Especially first-time buyers, who are most sensitive to affordability issues and the effects of rising rates, the rise in mortgage rates has forced many prospective homebuyers to reconsider their plans.

While buying activity often surges at this time of year, Vice President and Deputy Chief Economist Joel Kan of the MBA highlighted in a statement that rates have climbed significantly in recent weeks. The increase in mortgage rates has made many prospective homebuyers reevaluate their plans, particularly first-time buyers who are more sensitive to affordability difficulties and the effects of rising rates.

For buyers, that causes a lot of rate shock, according to Reynolds.

Read More: After The Fall For Straight Six Weeks, Mortgage Rates Rose Again This Week

Royal Bank Of Canada Raises Prime Rate To 2.7%; After Central Bank’s Hike

After The Fall For Straight Six Weeks, Mortgage Rates Rose Again This Week

Series Of Interest Rates Hikes Housing Market Highly To Crash Like 15 Years Ago

Some purchasers who are price-stunned don’t benefit much from lower home prices. The average property price in January was $400,000, down 11% over the previous 7 months, according to Realtor.com. At last week’s rate of 6.32%, the monthly mortgage payment for a home with the median price would have been $1,985, which is 42% more than last year’s payment but 6% less than it would have been in June 2022.

Reynolds told Yahoo Finance that a slowdown in demand “was expected.” “We experienced the worst seasonally adjusted reading for mortgage purchase applications in recent memory. If purchasers are becoming accustomed to higher rates, we’ll find out in the upcoming 30 days whether they’ll wait impatiently for rates to drop.

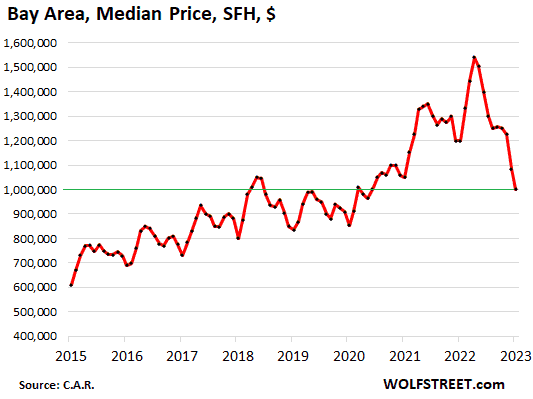

In the first 10 months of Housing Bust 2 (now), the median price plunged a lot faster than in the first 10 months of Housing Bust 1 (2007-11). The median price in the nine-county Bay Area plunged by another 8% in January from December, by 17% year-over-year, and by 35%, or by $540,000, since the crazy peak in April 2022, from $1.54 million to $1.00 million, according to the California Association of Realtors. (Photo via https://wolfstreet.com/)

Now is the moment to bargain

Since that sellers are continuing to reduce their hefty incentives in front of the spring selling season, the window of opportunity for prospective purchasers to get a decent deal may be closing shortly.

The National Association of Home Builders (NAHB) reports that at least 31% of builders cut home prices in February, compared to 35% in December and 36% in November. The average price decline also became more restrained, dropping from 8% in December to just 6% in February.

Due to the fact that mortgage rates had appeared to stabilize earlier this month, buyer incentives, such as mortgage rate buydowns, paying for closing costs, or renovations, were also restricted. According to NAHB, only 57% of builders provided incentives in February, a decrease from 62% in December and 59% in November.

A sign is displayed outside a house for sale in Pittsburgh, Jan. 4, 2019. (AP Photo/Keith Srakocic, File)

Reynolds warned that if buyer activity ramps up in the spring and home inventory stays low, “the opportunity to negotiate incentives may not last long.”

But that doesn’t mean you can’t bargain right now. Reynolds claims that one of his clients in Seattle recently received a 17% price drop on their home and additional contingencies that were paid for by the seller—deals that were challenging to secure a year ago.

“I have a client who just purchased a home that sat on the market for more than 7 months without selling. We grabbed it as soon as it was taken off the market and cut the price by $500,000,” Reynolds added. It was a fantastic negotiation. In addition to the price reduction, we were able to include an inspection and additional contingencies that aren’t often available in the market. For almost ten years, there has been a seller’s market.