A study in 2021 by the White House showed that the country’s 400 wealthiest families paid an average income tax rate of 8.2%. What could be the strategy of wealthy people to reduce their tax burden? GoBankingRates list some strategy that might be useful in this tax season.

Sell Declining Investment

Richard Lavina, a CPA and CEO of Taxfyle, recommends the strategy of “tax-loss harvesting.” This strategy involves selling a declining investment at a loss to balance the taxes you owe on profitable investments. He gave an example: some wealthy individual would sell a stock that has lost its value, allowing them to offset capital gains from other stocks they have traded. This strategy is helpful as it would reduce their tax bill and rebalance their portfolio.

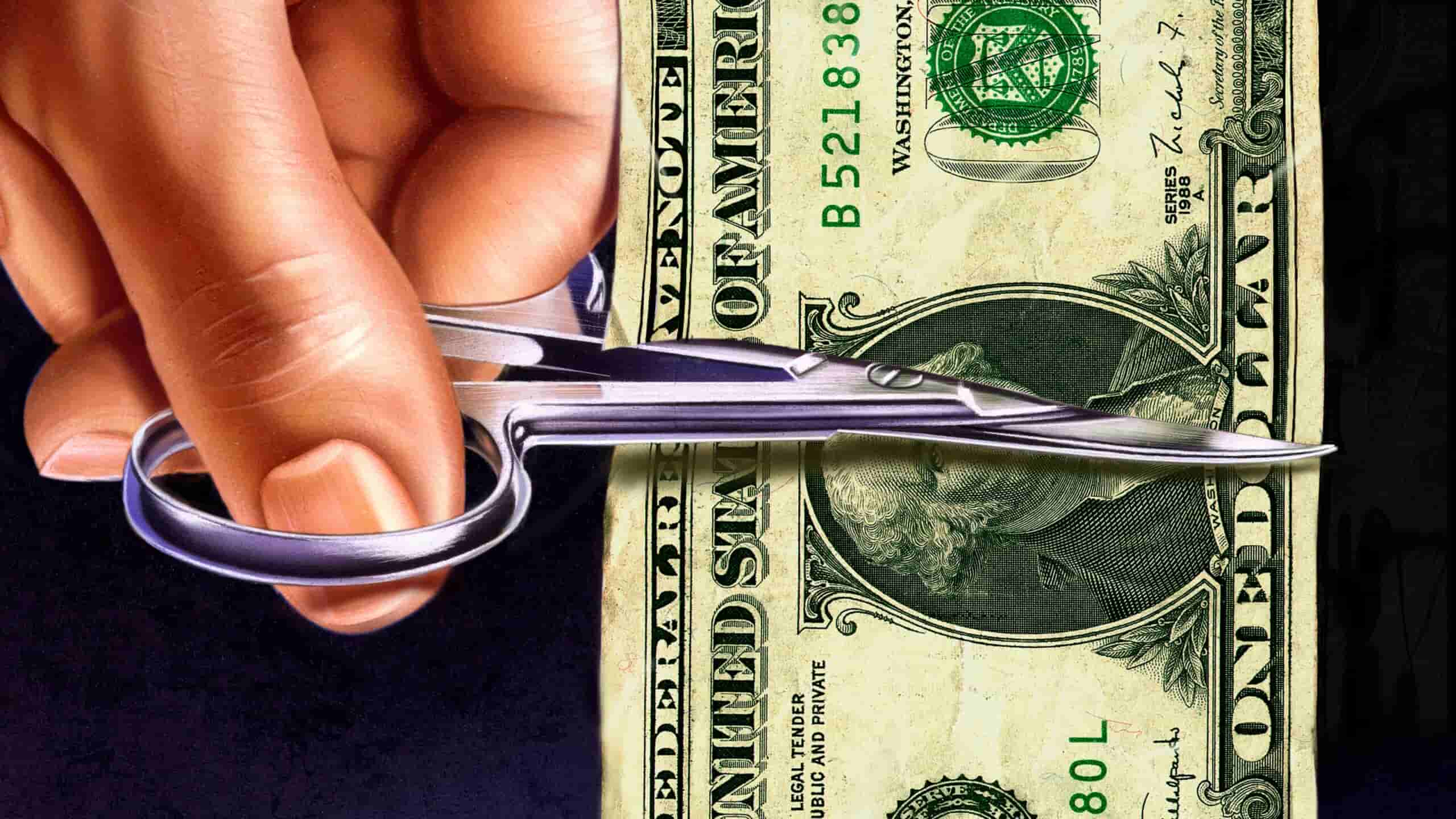

Check out these strategies on how to reduce your percentages in taxes. (Photo: Getty)

Put More Money Toward Retirement

One of the expensive mistakes is failing to utilize retirement accounts. Jason Escamilla, CFA and CEO of Impact Labs, advises moderate earners in high-income tax brackets to increase their retirement contributions. Moving funds from a taxable account to a Roth account is also recommended. He said taxpayers could withdraw contributions to the Roth IRA without paying taxes or penalties since it is not considered earnings.

Find Out: 2023 US Tax Season and Taxation: Understanding State vs Federal Income Taxes

More: 2023 Tax Season Guide: How to Get Better Tax Refund This Year

Wealthy people often own multiple companies using their business-related expenses to offset taxes. Small-business owners and freelancers can also use the strategy by reducing business-related expenses. You can do this by reducing expenses on marketing and advertising, business use of cellphones and the internet, accounting and legal fees, and supplies and business of vehicles. You can also take a home office deduction if you work from home.

Take Advantage of Tax Credits

Lavina recommends taking advantage of as many tax credits as you can. You can claim the Child Tax Credit, which reduces your taxes by $1,000 for each qualified child below 17 years old. You can also take advantage of the Earned Income Tax Credit (EITC), which offers a tax break to taxpayers earning below $59,187 per year. If you are pursuing higher education, you can also look if you are eligible for the American Opportunity Tax Credit and the Lifetime Learning Credit.

Read More: 2023 Tax Season: Guide for New Parents