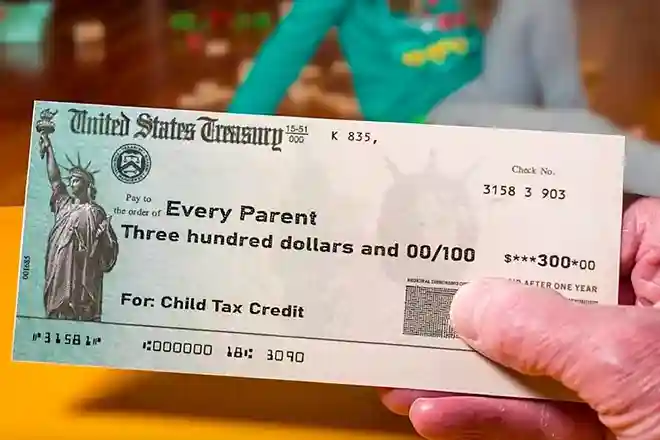

The expanded child tax credit in 2023 has been a popular topic recently, particularly as a response to the financial difficulties faced by many families during the COVID-19 pandemic. The credit provides financial assistance to families with children, helping them cover childcare, education, and other expenses.

A Morning Consult survey from July 2022 showed that around 59 percent of Americans, including 75 percent of parents with children under the age of 18, favored bringing back the $300 monthly payments.

Now, several states are considering new versions of the expanded Child Tax Credit 2023 to provide additional support to families and promote economic recovery.

Lawmakers in Illinois are proposing to make Child Tax Credit permanent. (Photo: Forbes)

Child Tax Credit 2023: States That May Expand CTC Program This Year

ITEP reports that eleven states currently provide child tax credit in 2023, three of which started the program last year.

There is still time for changes throughout the legislative session, but 10 more states are now contemplating an expanded CTC and discussing extending existing credits in Massachusetts, New Mexico, Colorado, and New Jersey.

These states include the following, as FiveThirtyEight reported:

| Has Pre-existing Program but No Expansion on the Table |

| California, Vermont, Idaho, Oklahoma, New York, Maine |

| Expansion of Pre-existing Program Possible This Year |

| Colorado, , New Mexico, New Jersey, Massachusetts |

| Governor or Legislator Interested in Creating a New Program |

| Arizona, Oregon, Connecticut, Nebraska, Hawaii, Montana, Illinois, Missouri, Minnesota, Maryland |

ALSO READ: Nebraska – Propose $1000 Child Tax Credit Aims To “Help Parents Close The Gap On Child Tax Credit”

How This Expansion Would Affect Americans

Millions of families around the nation will be affected by the outcome of this year’s planned child tax credits, including if they advance, whether they are modified, and whether they pass in the end. Politicians will also get a second opportunity to see whether this is a tactic that people will genuinely support.

Many Americans have a deeply entrenched mistrust of government assistance programs for the poor, which is sometimes driven by unfavorable and occasionally racist preconceptions about the impoverished and single moms. Certain MPs criticized the extended CTC as a costly welfare scheme.

However, the price of raising a child is going up, and it’s obvious that some legislators, particularly conservative Republicans, believe that incorporating family support into their state’s social safety net is a worthy enterprise. And if they are successful, it may pave the way for more governments to think about similar ideas in the future.

RELATED ARTICLE: The Child Tax Credit In 2023: Will It Exist?