Gov. Mike DeWine of Ohio wants to abolish the state sales tax on “critical infant supplies” such as diapers, wipes, cribs, car seats, strollers, and safety gear and enact a new child tax credit worth $2,500 per child.

The Associated Press also mentioned that DeWine wants to increase school vouchers, make mental health investments, and prepare major areas for economic growth by spending $2.5 billion.

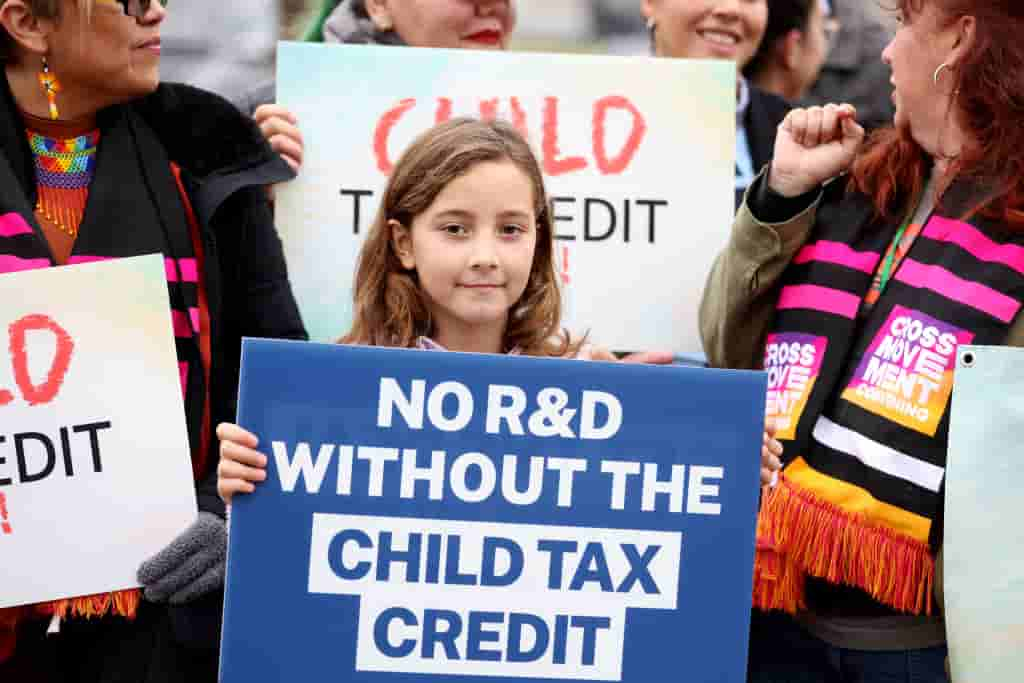

WASHINGTON, DC – DECEMBER 07: Supporters attend Press Briefing With U.S. House And Senate Champions, Impacted Families on Expanding the Child Tax Credit During Lame Duck Session on December 07, 2022 in Washington, DC. (Photo by Tasos Katopodis/Getty Images for Economic Security Project)

Ohio Gov To Expand Child Tax Credit 2023

Fox News affiliate WTOV reported that Ohio Governor Mike DeWine is requesting that the General Assembly consider expanding the child tax credit in the 2023 budget plan.

According to Lieutenant Governor Jon Husted, the financing would provide families more tax relief according to how many children the parents had.

“I think one of the hardest times for families is when you’re a young couple or a single parent and you’re struggling to hold down a job and take care of your children and we want to provide tax relief for those families,” Husted said.

“So, a $2,500 deduction for those families for every child that they have will help them spend their money a little bit easier on the things that they need,” he added.

The legislature must approve the deduction before taking into effect.

ALSO READ: $1,200 Child Tax Credit Could Be Given to Parents in Montana

How to Implement New Credit This Year

DeWine mentioned the proposed tax changes during his State of the State speech, which was delivered on Tuesday in the Ohio House chambers at the Statehouse.

His speech was short on specifics, but his staff promised that the state would provide more information later in the day, Cleaveland.com said.

DeWine said that the tax modifications would “ease the financial burden on new parents” and were a component of a larger package of ideas intended to promote Ohio as a location for raising kids.

The state must approve a new budget plan by June 30 to cover governmental expenses for the two years after that.

RELATED ARTICLE: $2,000 Per Child in Child Tax Credit 2023