“Forever Chi” to address the property tax crisis

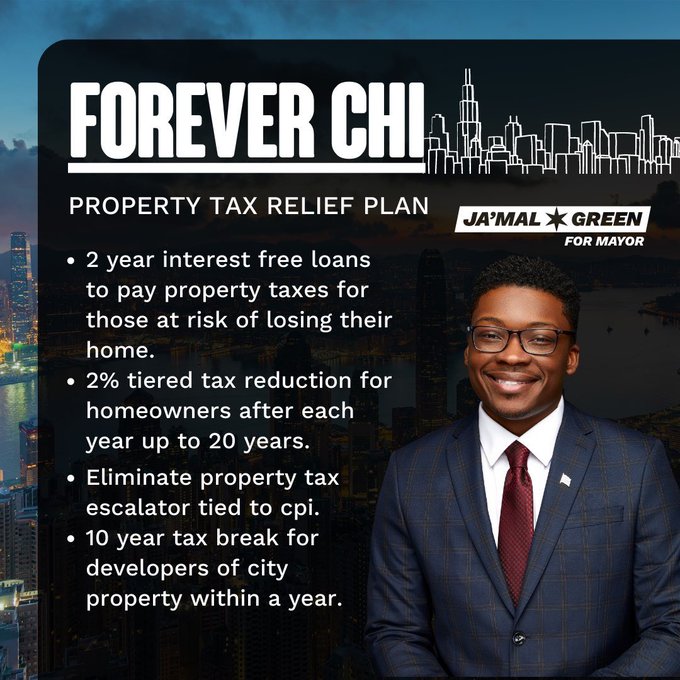

Ja’Mal Green’s Forever Chi Policy (Photo: @JaymalGreen)

Chicago mayoral candidate Ja’Mal Green laid out his plan for ‘Forever Chi’. The plan aims to address the ongoing property tax crisis that resulted in foreclosures and people leaving the city. The proposal includes the following:

- Two-year interest-free loans for homeowners at risk of losing their homes to pay their property taxes

- Loyalty Tax Credit

- Removing the property tax escalator put in place by Mayor Lori Lightfoot

- 10-year tax exemption for developers of city property within a year.

Green says, “We have thousands of vacant properties all throughout the city of Chicago, we want to incentivize folks to develop on them. We’re gonna give them a 10-year tax break if you develop that property within a year. We also are going to incentivize developers, who have single-floor buildings to build a floor above those buildings so that we can build affordable housing units in record time.”

Ja’Mal Green is a community activist and a marketing executive. Green is a member of a national political movement formed during the 2016 presidential election supporting Senator Bernie Sanders, a Vermont-based independent. He later served as Sanders’ surrogate during the 2020 presidential campaign. He also joined the 2019 mayor’s race, but later dropped out. If elected, Green would be the youngest mayor in Chicago’s history.

The race for Chicago mayor will be held on February 28, 2023. If no candidate receives a majority of votes, a runoff election will be held on April 4, 2023.