2023 Tax Update IRS – Here are 4 free tax filling options for eligible seniors. Tax preparation can be time-consuming and stressful, but it doesn’t necessarily have to be expensive.

For the 2021 tax season, the only location in Indian River County that will provide VITA services is the United Way Center, which can be found at 1836 14th Avenue in Vero Beach. VITA will be limited to a “drop-off valet model,” in which clients and volunteer tax preparers will not interact closely. If the client has any inquiries regarding their tax return, a tax preparer will get in touch with them via phone or text message. The IRS’s and health experts’ published guidance will be followed by the UWIRC’s VITA protocol. Photograph by https://unitedwayirc.org/)

You can submit your taxes for free using services supported by the IRS or online tax software if you simply need to complete a straightforward tax return or fulfill certain income requirements.

Read More: Employee Retention Credit 2023: Up To $26K Benefit Not Available For Workers

2023 Tax Update: Don’t Forget To Declare Income From Stolen Goods And Illegal Activities – IRS

Don’t panic if you are a retired US citizen having problems submitting your tax return to the IRS. The Internal Revenue Service itself might be able to assist you with filing your taxes. You don’t need to do anything extraordinary or difficult to get free assistance. But, in order to qualify for this assistance, you must fulfill some IRS conditions.

Furthermore, it is irrelevant if you achieve these conditions or not because the IRS offers a variety of assistance. While it is true that some forms of assistance are more beneficial than others, all assistance is beneficial when it comes to filing our taxes with the IRS. We therefore need to know how the Internal Revenue Service can be of use to us.

Get free assistance from tax professionals to make tax season easier for you and your elderly parent. Pensions, pre-death life insurance benefits, savings in an IRA or 401(k), or other financial assets are common among the elderly. Their tax preparation and filing may become more difficult as a result. (Photo courtesy of dailycaring.com)

We can always get in touch with a consultant if we still need assistance filing our tax return with the Federal Revenue Service. But, since we require our advisor to be formally affiliated with the IRS, we cannot use just any advisor. Otherwise, we can run into issues because it might be a con artist attempting to steal our tax refund.

IRS assistance in person for low-income individuals and elders.

Read More: Supreme Court To Hear Student Loan Forgiveness Challenges

Taxes Increase On Wealthy And Raise Spending – Biden’s 9.2T Budget

Tax Advice for the Elderly – The 60 and older taxpayers are given priority under the TCE program. TCE is an authority on queries pertaining to pensions and senior-specific retirement-related matters.

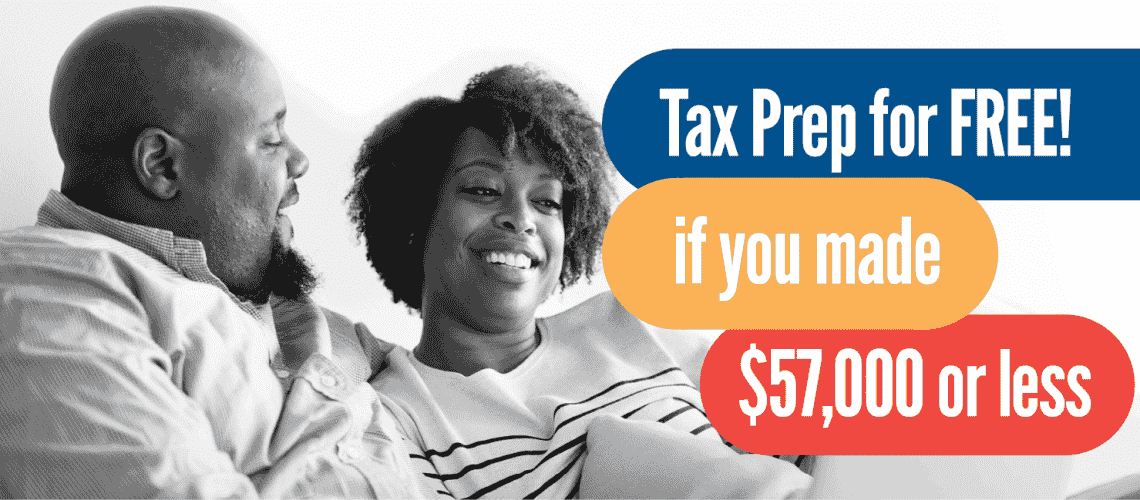

Volunteer Income Tax Help (VITA) – The VITA program often serves taxpayers who make $60,000 or less, have impairments, or speak limited English.

Taxpayers can use the site finding tools on the IRS Free Tax Preparation page of IRS.gov to identify a TCE or VITA location close to them.

Taxpayers who earn more than $73,000 per year can use Free File Fillable Forms even though IRS Free File has an income cap. As guided preparation is not offered with fillable forms, taxpayers must feel confident preparing their own tax returns. (Photo by https://fitischools.com/)

Using IRS Free File, which is accessible at IRS.gov/freefile, many seniors and retirees can file their taxes for nothing. For taxpayers with incomes of $73,000 or less in 2022, the program provides online tax preparation software.

Leading tax software firms make their online products available for free through this program, a public-private cooperation between the IRS and the Free File Inc. Seven goods are available this year in English and one in Spanish.

Each IRS Free File partner establishes its own requirements for qualifying based on age, income, and state of residence. To choose the best package for them, taxpayers can examine each of the offers or use the IRS Free File Lookup Tool.

Read More: Alleged Murderer Of A High School Football Player Enters A Not-Guilty Plea; Family Sues Mall

Biden’s Proposed 2024 Budget: Child Tax Credit Extension

The software for the program supports the majority of forms that can be submitted electronically, including the Form 1040-SR for seniors over 65.

Also, some program providers charge a fee while others offer free state income tax return preparation. The lookup tool can be used by taxpayers to locate the appropriate state product.

All program products are mobile-friendly, allowing taxpayers to file their taxes using a smartphone or tablet.

We can always get in touch with a consultant if we still need assistance filing our tax return with the Federal Revenue Service. But, since we require our advisor to be formally affiliated with the IRS, we cannot use just any advisor. Otherwise, we can run into issues because it might be a con artist attempting to steal our tax refund. (Photo by https://www.zeni.ai/)

Taxpayers who earn more than $73,000 per year can use Free File Fillable Forms even though IRS Free File has an income cap. As guided preparation is not offered with fillable forms, taxpayers must feel confident preparing their own tax returns.

Read More: SSDI Payment Schedule For 2023: Beneficiaries Are In A Happy Day

More Than $175B In Housing Investment: Biden’s 2024 Budget

Veterans who qualify may use MilTax.

Veterans who qualify can access MilTax online software, regardless of their financial situation, thanks to the Department of Defense. MilTax enables qualified taxpayers to create and submit up to three state income tax returns as well as their federal tax returns for free.